The CenturyLink payment arrangement allows you to schedule and split payments after the bill’s due date, as long as the full balance is paid by the due date to keep your account in good standing.

Credit: afrozahmad.com

Understanding Centurylink Payment Arrangements

The CenturyLink Payment Arrangement is a complete guide that allows customers to schedule their payments after the due date and split the payments across multiple sources. It ensures that as long as the full balance is paid by the due date, the account remains in good standing.

Avoid missed payments and enroll in Autopay for a hassle-free experience.

What Is A Payment Arrangement?

A payment arrangement is an agreement between a CenturyLink customer and the company to pay off severely overdue debt in installments. When a customer enters into a payment arrangement, their bill will contain charges for both their current services and the amount they agree to pay in installments.

How Does A Payment Arrangement Work?

When you set up a payment arrangement with CenturyLink, you can schedule your payment to be made after the bill’s original due date. This allows you some flexibility in managing your finances and ensures that your account remains in good standing as long as the full balance is paid by the agreed-upon date. Additionally, CenturyLink gives you the option to split your bill payment across multiple payment sources, making it even more convenient to pay off your debt.

Benefits Of Using A Payment Arrangement

- Flexibility: The ability to schedule your payment after the bill’s due date gives you more control over your finances.

- Good standing: As long as you pay the full balance by the agreed-upon date, your account will remain in good standing.

- Multiple payment sources: You have the option to split your bill payment across multiple payment sources, making it easier to manage your payments.

By utilizing the CenturyLink payment arrangement, you can ensure that you stay on top of your bills while also having the flexibility to pay them off in a way that suits your financial situation.

Making A Centurylink Payment Arrangement

Making a payment arrangement with CenturyLink is easy and convenient. Whether you choose to pay online, over the phone, by mail, or in person, you have the flexibility to split your payment across multiple sources as long as your full balance is paid by the due date.

By following these simple steps, you can ensure your account remains in good standing.

Steps To Make A Payment Arrangement

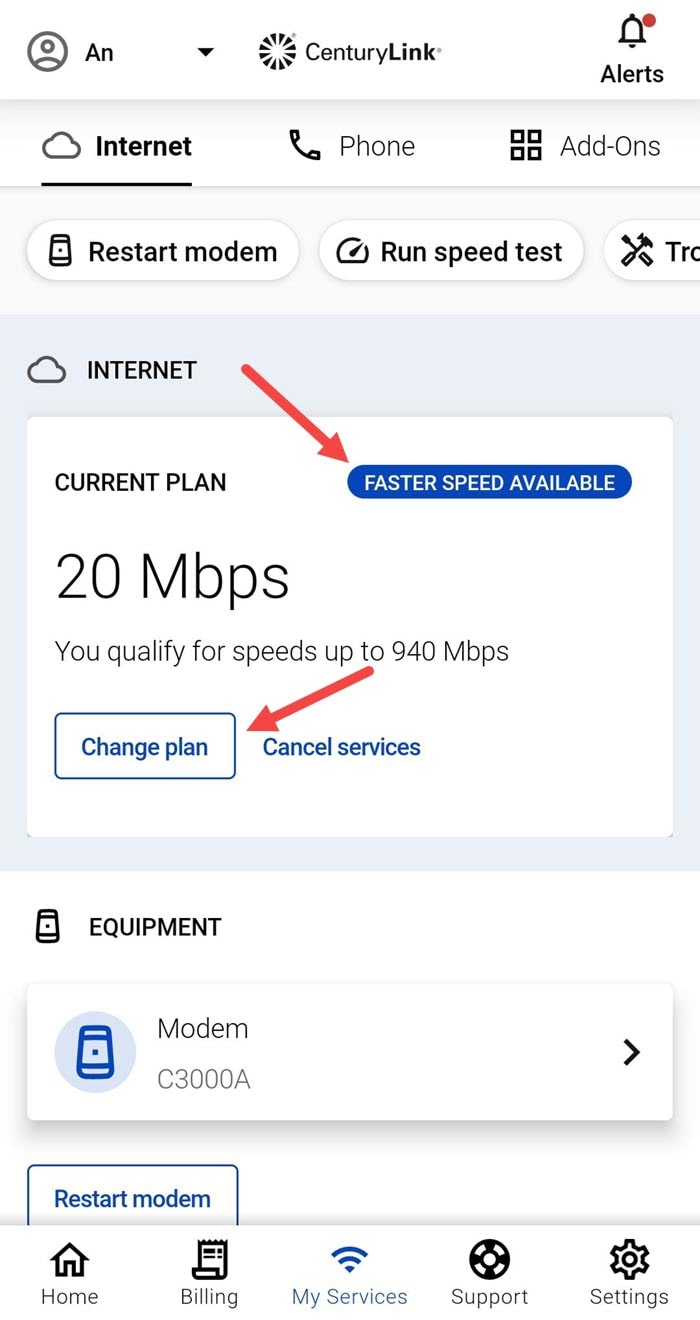

If you find yourself in a situation where you are unable to make your CenturyLink payment on time, don’t worry. CenturyLink offers a convenient payment arrangement option that allows you to schedule your payment after the bill’s due date. Here are the steps to make a payment arrangement:- Log in to your CenturyLink account: Visit the CenturyLink website and log in to your account using your username and password. If you don’t have an account, you can create one easily.

- Access the payment arrangement feature: Once you are logged in, find the “Payment Arrangement” option on your account dashboard. Click on it to proceed.

- Select the bill you want to make a payment arrangement for: If you have multiple bills, choose the one you need to make a payment arrangement for.

- Choose the payment arrangement details: Specify the amount you can pay and the date you would like to make the payment. CenturyLink offers a flexible payment arrangement process to suit your individual needs.

- Review and confirm the payment arrangement: After providing the necessary details, review the payment arrangement summary. Make sure everything is accurate before clicking on the “Confirm” button.

- Follow the payment instructions: Once you have confirmed the payment arrangement, CenturyLink will provide you with instructions on how to make the payment. Follow these instructions to complete the process.

Payment Options Available

CenturyLink offers several payment options to make the payment arrangement process convenient for its customers. These payment options include:- Online payment: You can conveniently make your payment arrangement online through the CenturyLink website. Simply log in to your account, select the payment arrangement option, and follow the instructions provided.

- Phone payment: If you prefer making payments over the phone, you can contact CenturyLink’s customer service and provide the necessary details to set up a payment arrangement.

- Mail payment: CenturyLink also accepts payments through mail. Simply send a check or money order along with your payment arrangement details to the address provided by CenturyLink.

- In-person payment: For customers who prefer making payments in person, CenturyLink has authorized payment centers where you can visit and make the necessary payment arrangement.

Considerations Before Making A Payment Arrangement

Before making a payment arrangement with CenturyLink, there are a few considerations you should keep in mind:- Review your financial situation: Assess your current financial situation to determine the amount you can comfortably pay and the date by which you can make the payment.

- Understand the terms and conditions: Familiarize yourself with CenturyLink’s terms and conditions for payment arrangements. Make sure you fully understand the agreement before proceeding.

- Communicate with CenturyLink: If you’re facing financial difficulties, it’s a good idea to communicate with CenturyLink’s customer service. They may be able to provide additional assistance or offer alternative payment options.

- Stick to the arrangement: Once you have made the payment arrangement, it’s important to stick to the agreed-upon terms. Make sure you pay the scheduled amount on time to avoid any further complications.

Managing Centurylink Payment Arrangements

Looking to manage your CenturyLink payment arrangements? Our complete guide provides step-by-step instructions on how to make partial payments, set up extended payment arrangements, and avoid late fees. Find out all you need to know about managing your CenturyLink bill payments efficiently.

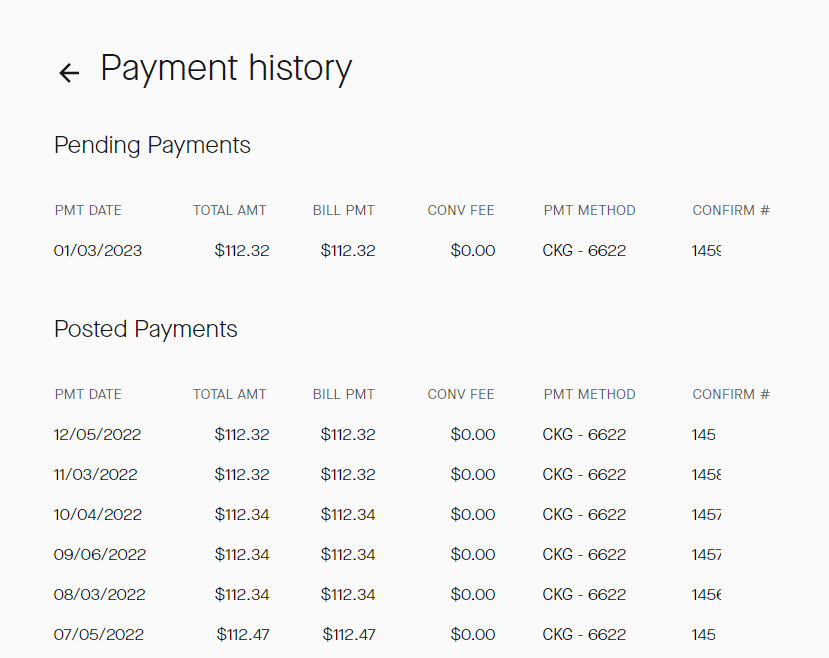

Tracking And Updating Your Payment Arrangement

Once you have set up a payment arrangement with CenturyLink, it is important to keep track of and update your arrangement as needed. This will ensure that you can stay on top of your payments and avoid any potential issues. Here are a few tips for tracking and updating your CenturyLink payment arrangement:- Mark your calendar: Make a note of the dates when your payments are due and set up reminders to ensure you don’t miss any deadlines.

- Monitor your account: Regularly check your CenturyLink account to see if there are any changes or updates to your payment arrangement.

- Update your payment method: If you need to change your payment method or update your banking information, make sure to do so promptly to avoid any delays in processing your payments.

- Communicate with CenturyLink: If you encounter any issues or challenges that could affect your ability to make your payments, reach out to CenturyLink as soon as possible to discuss possible solutions or alternative arrangements.

Consequences Of Missed Payments

While CenturyLink understands that financial difficulties can arise, it is important to be aware of the potential consequences of missing payments on your payment arrangement. Here’s what you need to know:- Late fees: Missing a payment deadline may result in late fees being added to your account, which can increase your overall balance.

- Service interruption: Failure to make payments as agreed upon in your arrangement may result in service interruptions or disconnections.

- Negative impact on credit score: Consistently missing payments can have a negative effect on your credit score, making it harder for you to obtain credit or loans in the future.

- Loss of payment arrangement privileges: If you consistently miss payments or fail to adhere to your payment arrangement, CenturyLink may revoke your arrangement privileges, requiring you to pay the full balance immediately.

Alternatives To Payment Arrangements

If you find that a payment arrangement is not suitable for your current financial situation, CenturyLink offers alternatives for you to consider. Here are a few options:- AutoPay: Enroll in AutoPay to have your payments automatically deducted from your chosen bank account or credit card, ensuring that you never miss a payment deadline.

- Extended payment arrangement: If you need additional time to pay your balance, CenturyLink may offer an extended payment arrangement that allows you to spread out your payments over a longer period.

- Financial assistance programs: CenturyLink provides various financial assistance programs that can help eligible customers manage their bill payments. Contact CenturyLink customer support to learn more about these programs and see if you qualify.

Credit: broadbandnow.com

Credit: www.centurylink.com

Frequently Asked Questions Of Centurylink Payment Arrangement: Complete Guide

Can I Pay Half Of My Centurylink Bill?

You can pay half of your CenturyLink bill by making a partial payment online, over the phone, by mail, or in person. Just make sure to pay the full balance by the due date to keep your account in good standing.

You can also split the payment across multiple sources.

How Is The Payment Arrangement?

A payment arrangement is an agreement to pay off overdue debt in installments. You can make partial payments online, by phone, by mail, or in person, as long as the full balance is paid by the due date. Your bill will include charges for both current services and the payment arrangement installment.

What Is The Grace Period For Centurylink?

CenturyLink does not offer a grace period. Your payment needs to be received by the close of business on the due date.

What Is An Extended Payment Arrangement?

An extended payment arrangement is an agreement that allows eligible customers more time to pay the balance on their account. This arrangement gives them the flexibility to pay off their debt in installments rather than all at once.

Conclusion

To effectively manage your CenturyLink payments, utilize their payment arrangement feature. This allows you to schedule payments after the due date and even split them across multiple sources. By paying the past-due balance before the current bill’s due date and the remaining balance by the regular due date, you can ensure your account remains in good standing.

With CenturyLink’s flexible payment options, you can take control of your finances and avoid any late fees or missed payments. Explore the complete guide to CenturyLink payment arrangements to streamline your payment process.